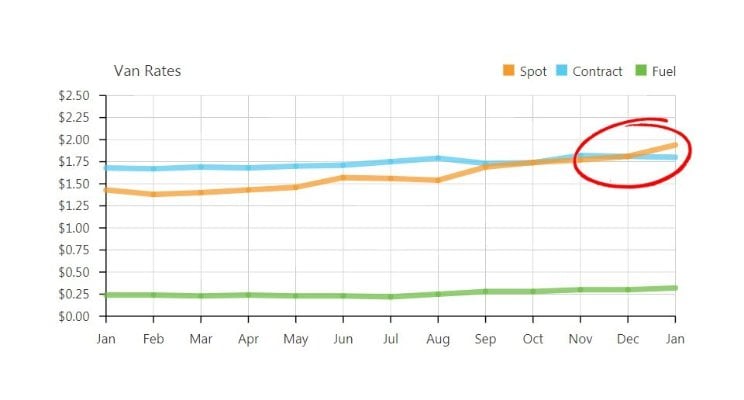

This past month was new territory for many in the transportation industry, with spot rates ticking above contract rates according to data from DAT.

What’s so bizarre about this? It’s a reflection of how weird the supply and demand has become in the trucking industry as carriers are choosing to haul the “one-off” brokered load over the traditionally more attractive “shipper-direct” load. Brokers and 3PLs, which traditionally have the most leverage with carriers in the marketplace, now are paying on average higher rates than shippers. Weird indeed.

Wait, huh?

If you’re already lost, allow me to explain and define the ‘Spot’ and ‘Contract’ rates.

Spot rates are simply defined as the rate that a broker/3PL (who sources and manage the transportation) pays the carrier. They’re the important middle-man in the exchange, ensuring that the pickup, delivery, and service is executed to the required standard and that the carrier is vetted. Contract rates reflect a direct agreement between the shipper and carrier – no broker or 3PL involved. There are pros and cons to both types of arrangements, depending on the shipper’s size and core competencies in managing transportation.

The key point here though is that the script has flipped in the past few months and the trends lines have been pointing to this since last September when we started to see a slight decline in contract rates and continued increases on the spot market. There are many contributing reasons – the ELD Mandate that went into effect on Dec. 18th, the overall shortage of truck drivers, and the “Amazon Effect” where all shippers feel the need to delivery to the consumer at a more rapid pace, but it all points back to the fact that carriers have all the leverage in the marketplace right now.

I’m a Shipper – so what should I do?

My advice is this – identify the carriers that have provided consistent quality and value over the past few years and collaborate with them on a dedicated carriage contract (DCC) agreement that will lock-in your rate for however long you’re comfortable locking in.

Two reasons for this:

- All indicators point to rates continuing to rise in the industry for the next 3-5 years. This year alone, average rates are predicted to rise 10%. In the past year, spot rates have risen 35%. You’re playing Russian roulette if you think you can get a better deal by waiting this out.

- You’re looking into a “known thing.” If you have established trust with your carrier and that carrier is a vetted partner, then it’s to both parties’ benefit to lock-in a longer-term arrangement.

I’m also a big fan of stepping back and looking at your supply chain from a macro view. A few questions to ask:

- Is our product becoming subjected to the “Amazon Effect” where customers expect it within 1-3 days?

- Is it a ‘time-sensitive’ product where that lead-time is justified or would we be better off with longer lead-times to the customer? Would the customer accept that?

- Is your inventory so lean that everything inbound and outbound is a “rushed” shipment?

The odds are that without controls in place, you’re likely paying premiums on top of your regular freight costs to rush a shipment that shouldn’t have been rushed in the first place.

But our company is really big – we have the best transportation rates in the industry…

I can’t tell you how many times I’ve heard this before. In my head, I like to credit a sleek sales guy at one of the big brokerage firms for selling that so effectively, and you technically may have “great rates,” but that doesn’t mean your transportation is cost-effective or subject to frequent service failures. You may have the best rates in the world, but it doesn’t mean anything if your shipments aren’t getting picked up consistently or if your damage rate is through the roof.

And now, the data is clear that you’re probably paying more for your transportation than a competitor who was proactive in locking in a DCC agreement with a trusted carrier.

No really, our enormous reverse-auction annual lane bid is the best thing since sliced bread

While I like this free-market concept, it never seems to work according to plan. The low bidder often offers less quality than you desire, leading you to procure a secondary or tertiary carrier and then by the time the year wraps up, you paid more tendering shipments to a variety of carriers that you didn’t anticipate tendering to than if you had just selected the right balance of cost and quality in a carrier in the first place. But I digress…continue your reverse auction annual quest. May it not bring you pain and sorrow again this year.

Okay, so what are the other options?

It’s time you looked at your freight holistically and not just as a “lane” or transactional exchange. One of the benefits of a DCC agreement is that they’re your trucks. You get to pick and choose where to send them, and it’s to everyone’s benefit to keep them moving. A few tricks that I’ve learned:

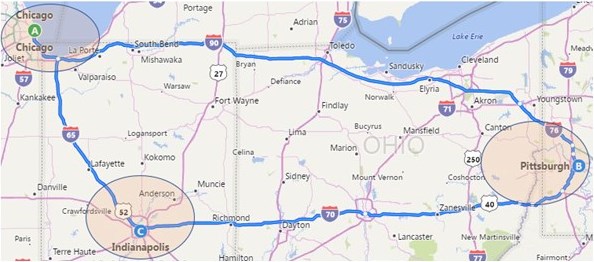

- Matchbacks and Triangles – there’s so much to gain from looking at your freight patterns and the specific pickup and delivery locations. For example, think about the triangle below. It would be a great closed-loop route if you had consistent volume (both headhauls and backhauls) in those specific lanes. Then the challenge is just “matching” up that freight in a way that keeps the driver busy and not detained at loading docks waiting for the next load. You may even need a Transportation Management System (TMS) to execute this, but it could be well worth the endeavor.

- Delivery dates, not “ship” dates – the goal is to get the freight to the customer when they desire (meeting the delivery date) and not just to meet an arbitrary goal of getting it off your dock. Work backward through your supply chain to prioritize orders/deliveries. This will help prioritize your loads so that you can plan them accordingly and maximize the flexibility you have, which is especially important with a DCC solution.

- Milkruns – it’s an old-school term, but highly effective in helping establish consistent routes and expectations with suppliers and customers. For example, simply putting business rules on which days the DCC driver would pick up and deliver to a location saved one of my customers over 30% annually in freight costs. After all, picking up two pallets every day of the week from a location doesn’t make as much sense as 1 or 2 pickups of larger quantities in a week.

None of this is rocket science, but deciding what to do and executing on it is everything. Just remember, it’s not just about the rates – it’s about the relationships too.