Whether you are a Logistic Service Provider (LSP), or use LSP services, the following article provides valuable insights into why it is important for providers to be transparent about their financial condition in today's challenging market.

Users of LSPs will find valuable information about how to assess the condition of their providers, and LSPs will learn how they can best position themselves with customers.

The financial industry meltdown will continue to have a ripple effect through commerce for years to come. Now, many long-standing financial institutions are changing the game of well-established business relationships, seemingly overnight. What does this mean to those who rely on LSPs for supply chain solutions? Historically, LSPs have funded operating expenses and capital investments. Today, banks have tightened their lending practices making cash less available. This additional banking pressure has made it more difficult for LSPs to finance start up costs and incur working capital increases. Looming in the future is the potential for increases in interest costs, cash flow shortages and a strain on the financial viability of many over-leveraged LSPs.

The economic downturn has created significant challenges for both shippers and third-party logistics providers(LSPs)—82 percent of shippers are employing cost-cutting tactics and 60 percent are rethinking their supply chains and relationships with LSPs as a result.*

Why is the financial condition of your LSP important? Let’s answer that question with three more questions:

- How much of the customer’s inventory is held by your LSP, either in transit or in warehouses?

- Does the LSP directly touch the customers?

- Are you confident that the LSP will have the financial means to continue I.T. and engineering improvements that reduce costs and create a competitive edge?

If these questions raise doubts about your LSP relationships, it’s time to qualify their viability.

In the current financial environment, wise companies minimize risk by performing proper due diligence review of significant business partners, including LSPs. Today’s LSPs face extreme pressure from banks due to significantly restricted lending practices. In addition, LSPs are pinched between customers who impose extended payment terms and the requirement to pay associated labor weekly. So how can you determine if your LSP is capable of handling the added burden of restricted access to capital?

“Shipper-LSP relationships are being impacted significantly by the prevailing uncertainty and economic volatility in global markets,” said Dr. C. John Langley, Jr., Professor of Supply Chain Management, Georgia Institute of Technology. “It is very important for 3PL to mitigate or reduce any financial risk or service level impact that this may cause.” *

A critical review of your LSP’s financial health is imperative to prevent disruptions in your supply chain. To conduct a LSP financial review, rely on independent sources as well as requesting information from the LSP, which should be more than willing to help you to qualify their financial standing as a potential vendor.

The LSP should be able to provide:

1. Bank references. Check them thoroughly.

2. Certificates of insurance. What are the minimum levels of insurance required by your risk management group?

3. Financial data for the past several years. This information should include basic financial statements including the balance sheets, income statements, cash flow statements, as well as financial statement footnotes. The information should be for the most recent two calendar or fiscal years and include any available interim financial statements. The accountant’s report should also be reviewed to see if there have been financial issues raised.

If the company is a public company then the 10K annual report and the most recent 10Q quarterly report will provide what you need. If the company is private, then the information will need to be requested directly.

4. Customer base. Obtain from the LSP a listing of major customers and inquire about the dollar volume of sales for large customers. Determine whether sales are concentrated in only a few customers and whether the risk of the loss of any one customer or group of customers could adversely impact the company’s ability to provide continued service to you.

Generally a large concentration of customers must be disclosed in financial statements. If the company is public this may also be discussed in the risk factors section of the SEC 10k filings along with other risks to the company.

Your independent research should include:

1. Credit report. This can be obtained from credit reporting agencies like Dunn & Bradstreet (D&B).

2. Financial rating by independent firms. Rating agencies, like Moody’s or Standard & Poor's, provide an objective measurement of the risk of a company’s obligations using a standardized rating scale. Generally, ratings are only available for companies that are publicly traded or for companies whose debt is publicly traded. If a rating is available it can indicate the credit-worthiness of the company and is often a good indicator as to the financial stability of the company. Ratings that are close to “junk bond” status may indicate a concern.

Ratings do not exist for privately traded companies so review of their financial statements and other methods listed here can be helpful.

3. Outstanding claims or liens. Credit reporting agencies like Dunn & Bradstreet provide information on outstanding liens and claims. These liens and claims may be the result of normal secured credit filings or the result of unpaid vendors. Looking at the detail can indicate how the company deals with its vendors or other business relationships. Since UCC filings and liens are public information a search of public records can also show outstanding items.

4. Vendor ratings for payment history. Vendor payment history is often reported to credit agencies like D&B. You can obtain a D&B report by subscribing to their service or paying as you need a specific report. This information is available online.

5. Private equity funding for the impact on available cash. Press releases and the websites of the private equity firms are a great place to learn more about the ownership of private equity owned companies. This information will yield insight as to how the firms operate and the potential impact on the companies which obtain their investment.

Most private equity firms focus on delivering extraordinary returns as fast as possible and have a stated investment philosophy and investment time horizon. These stated strategies include turning around under-performing companies, rolling up companies within the same industry, reducing costs to improve financial performance, growing companies through acquisitions, and other strategies that focus on large returns where time is of the essence. This often results in significant financial events such as sale of the firm to another private equity company, going public, break up and divestiture of business units or division, etc.

A private equity firm’s track record of buying and selling can be determined by reviewing the press releases of recent acquisitions.

6. Acquisition costs that have negatively impacted financial resources. Acquisitions are often reported as press releases on a company’s website or can be discovered by an internet search. Examine the size, funding source and business rational for acquisitions. A large acquisition which requires significant outside debt funding can be a distraction and a source of concern. The integration issues such as merging systems, reducing duplicate locations, blending cultures, spinning off unwanted product lines or services, etc. can be a distraction to the core business and disrupt long standing relationships while people and resources are displaced.

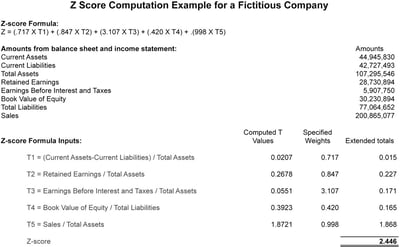

7. Your LSP’s risk of financial failure. A scoring mechanism, like the “Z-score”, developed by Edward Altman in 1968, can predict bankruptcy.

The Altman Z-score is a financial measurement tool that uses a company’s income statement and balance sheet to evaluate the risk of bankruptcy. The Z-score methodology is often used in the vendor selection or credit approval process. The Z-score’s calculations are based on financial data from a company’s financial statements. The Z-score is computed by multiplying five individual factors by specified weights.

8. Review initially, then periodically.

A review of the financial health of service provides should be completed before contracts are initially signed or renewed. And these financial condition should be reviewed annually. If there are changing conditions such as a change in control of the service provider or if the provider is considered at risk, then a more frequent review should be considered.

A thorough review will provide additional assurances that your LSP will be a long term partner. To be highly effective in every aspect of its service to you, your LSP must be financially robust and willing to invest in its business. Can you say that about your providers now?