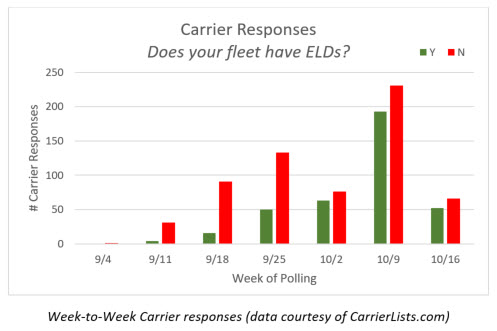

According to CarrierLists.com, only 35% of respondents are ELD-compliant. With the Electronic Logging Device (ELD) mandate set to take effect in two months, we are starting to see some data and evidence that many smaller carriers are procrastinating on obtaining ELDs, which could abruptly impact pricing and capacity to close out 2017, taking full effect in Q1 2018.

Polling over 1,100 carriers small to midsize carriers[1] over the past three weeks, CarrierLists.com found that only 35% of carriers are currently ELD complaint as of 10/19/17 (less than 2 months until the deadline).

Kevin Hill, President & Founder of CarrierLists.com, found the numbers staggering. “We were talking with customers and continued to hear this reoccurring theme and simply started a tally,” Hill said. “Here we are several weeks later, and the results are somewhat astounding considering the mandate is in effect in less than two months,” he added.

During the past three weeks that responses have been collected, the response rate has stayed incredibly consistent at around 45% despite the much larger number of responses collected. While we expect this percentage to increase up to (and past) the deadline, it’s still alarmingly low considering the remaining timeframe for implementation.

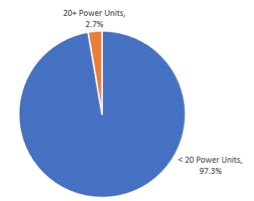

According to the American Trucking Association (ATA), 97.3% of carriers operate fewer than 20 power units, and with over 586,000 for-hire carriers on file with the Federal Motor Carrier Safety Association, that means that as many as 380,000 carriers aren’t “ELD-ready” with the mandate set to take place on December 18. Given the sample size and number of carriers on file, we can say with a high degree of confidence that fewer than half of the operating carriers in the United States are ready for this change.

FMCSA Carriers on File, by Fleet Size (courtesy: ATA)

What does it all mean?

The larger fleets on the road are likely well ahead of the curve and have ELDs in place today. However, if only 35% of all fleets have ELDs, expect capacity to quickly tighten in mid-December. According to some publications (including a recent Wall Street Journal article), many theorize that a portion of these smaller carriers will simply leave the industry altogether.

What we almost certainly know is that rates will go up. How much remains to be seen, but carriers will certainly have a position of leverage considering the following facts:

- Current Driver shortage of 50-100k drivers

- Bloomberg reported the industry was short 48k drivers in 2015, on track for the 175k shortage in 2014.

- Recruiting continues to lag, and the driver workforce continues to age, retire, or find other less demanding work.

- Fewer fleets = less price competition

- If a portion of the smaller carriers exits the business, there’s simply less competition amongst carriers, leading to price increases.

The sky is falling, right?

Not exactly. We’re not crying “Chicken Little” here, but it’s important to understand the possible and probable outcomes in the next few months as supply and demand balance out. To put some context around the gravity of the situation, consider what happened to carrier capacity with the two recent major hurricanes, and in this example Hurricane Harvey:

- Capacity tightened as FEMA loads flooded the market, often paying much higher than the market Consider DAT’s analysis of one lane from Dallas, TX to Seguin, TX after Harvey:

- The lane’s average spot rate changed from $577 in July to $858 in the week after Harvey, with some loads paying more than $1,350!

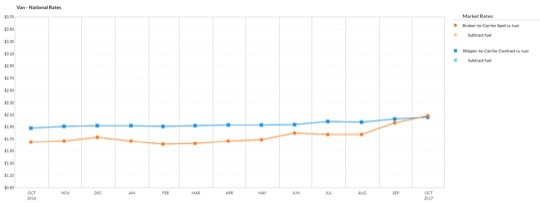

This is in addition to spot rates climbing from an average of $1.65/mile to $2.08/mile in one year (a 26% increase!) per data from DAT.

There’s also an expectation that major carriers will continue to seek price increases in 2018. In Supply Chain Quarterly’s recent interview with Mike Regan of TranzAct Technologies, he specifically mentions one carrier sending a memo to their customers regarding an upcoming 10% rate increase among other topics. This is simply a new age in transportation, and rate increases are inevitable.

Dry Van National Rates (courtesy of DAT.com)

So, now what?

Glad you asked. We recommend taking the following proactive strategy as a shipper.

- Create relationships with those that have relationships

- At Kenco, we pride ourselves in curating and maintaining many relationships with shippers and carriers alike to ensure there are always many options on the table. We analyze shipment files daily to mine out savings opportunities for our customers.

- Already have a relationship? Cool. Add to those relationships by allowing a 3PL and Transportation Management to manage freight on your behalf. Often, that’s the “value” that can be quickly realized – be it through better rates than the shipper can obtain on their own or creative, outside the box solutions like mode shift through multi-stop routing. Additionally, the shipper can allow the Transportation experts to worry about all the details and complexities (e. vetting the carriers, status updates, etc.) to simplify the entire process.

- Think outside your existing supply chain

- Interestingly enough, dedicated contract carriage (DCC) models have been a hot topic lately for customers that have the volume to warrant it from a cost-benefit perspective or simply want to hedge against market fluctuations. Although TUMS are still good anecdote for indigestion, there’s some value in being able to predict your costs as

you budget with a DCC fleet that you simply tender capacity to. - Focus more on your customer’s “requested arrival dates (RADs)” than simply clearing your dock and working off of the ‘ship by’ date. By planning off of RADs or simply working backward from a lead-time perspective, we often see savings opportunities of up to 10% through multi-stop routes.

- Interestingly enough, dedicated contract carriage (DCC) models have been a hot topic lately for customers that have the volume to warrant it from a cost-benefit perspective or simply want to hedge against market fluctuations. Although TUMS are still good anecdote for indigestion, there’s some value in being able to predict your costs as

Example of Savings via Mode Shift through Multi-Stop Routing

To Sum It All Up:

Even if you are planning ahead of the ELD mandate, it is a good idea to keep your finger on the pulse of freight cost control. Read up on your options with our Freight Costs eBook, full of innovative solutions to keep your operations moving forward, no matter what the market has in store.

[1] Defined as a fleet size of 100 or fewer power units